Seattle has long been one of the fastest-growing cities in the country. While the weather may not be as good as California's, it’s still very moderate and consistent compared to other regions in the United States. It also has a large and still growing tech industry with plenty of high-paying jobs.

There’s a vibrant nightlife and music scene, some of the best restaurants in the world, and a breathtaking skyline. It’s easy to see why Seattle has become such a popular place to live. It has also become a popular place for real estate investors. What is it about the Seattle rental market that has made it attractive for both small landlords and large real estate firms? Here’s an overview to help explain the basics.

Population growth

During the pandemic, like other cities, Seattle saw its population growth trend reverse and decline for the first time in years. This led some pundits and opinion columnists to suggest that maybe the era of urban growth had ended. People were finally over the city life and the suburbs is where the new population boom would take place.

Continued population decline would be bad news for landlords and the economy as a whole in Seattle. While there would still be plenty of demand for housing even with a sustained population decline, it would mean the demand and the supply would become more balanced and slow the increase of rent.

It would appear that the predictions of doom and gloom for urban life were a bit premature and the trend that’s lasted for thousands of years of people moving from less densely populated areas to more densely populated areas has continued. There are many reasons why people left the cities during the pandemic. Some did it for financial reasons. Some who had planned to leave the city in the future decided it was time. Some did it because they were able to work remotely. Regardless of the reason, people are either returning to the city, or it is seeing new residents moving in.

In the last year, it is estimated the population of Seattle has increased by 20,100 residents. That’s a population growth of 2.7% and one that outpaces the rest of King County by almost 2 to 1. It’s also outpaced Snohomish and Pierce County combined. This is in line with a state that also saw its population grow by 1.3% over the last year. Not only will housing in Seattle continue to be in high demand, but so will housing in the rest of the state.

Vacancy rate

How in-demand is housing in Seattle? Contrary to popular belief, new housing developments don’t sit vacant for years while developers collect tax write-offs. According to the most recent U.S. census data, the vacancy rate for both rental and home-buyer markets is the lowest they have been since the 1980s. This was also data that was collected during the pandemic which means the vacancy rates could be even lower now.

This is an ideal market for landlords. Low vacancy rates mean tenants are unlikely to move, meaning you can increase rent accordingly without worrying about looking for new tenants. If your tenants do decide to move, in a tight rental market, you’ll have potential tenants competing for your rental unit instead of the other way around.

Outside of major population or economic decline, the demand for housing should outpace the supply for the foreseeable future. It’s not just Seattle with low vacancy rates. According to a Washington State Study, the vacancy rate for apartments statewide fell from 4.2% to 3.6% in 2021. This means that tenants in the Seattle area looking for a less competitive market don't have many options.

The low vacancy rates are a nationwide trend. According to searches on Apartmentlist.com, many in the Seattle area searching to leave are looking for apartments in other low vacancy cities like Portland and Los Angeles and these are some of the same cities where people are searching for apartments to relocate in Seattle.

Housing Supply

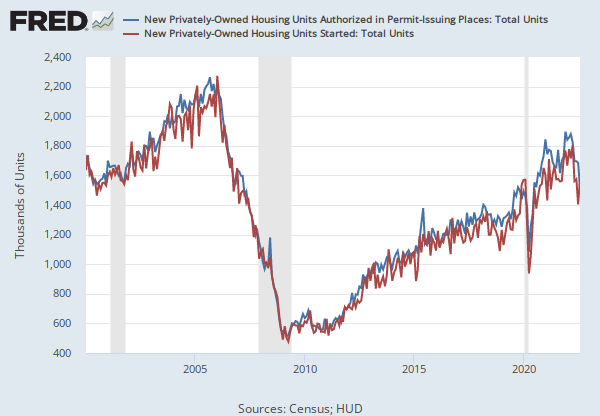

The construction of new housing over the decades has steadily declined and almost came to stop during the Great Recession. It took years for construction to ramp up after the recession and even then construction hasn’t increased fast enough to make up for the slow down during the recession. While some areas of the country and the northwest had a surplus of housing, most of those surpluses have quickly disappeared.

16 metro areas across the northwest including Idaho, Washington, and Oregon all have major housing shortages. This has caused both home prices and rents to increase dramatically over the years. This means there aren’t many options for those who are looking for relief when it comes to the high cost of living. While some areas may be cheaper than others, the cost/benefit of living farther from the urban center may not be worth it anymore.

Since the housing shortage is a regional problem, it’s not something that one city can address. Seattle can’t build enough homes in the city limits to handle the needs of the entire Seattle metropolitan area. While newer buildings can have downward pressure on older rental units, in the long run, rents will continue to increase as long as the construction isn’t outpacing the demand.

Housing shortages often lead to crowding. This means you’ll have more people living in a unit than the desirable number. For example, two friends may be splitting a one-bedroom apartment or a couple in a one-bedroom unit instead of two bedrooms. This means you now have two incomes competing with people with one income for the same unit. The same goes for roommates who split a three or four-bedroom home where two parents have to compete with three or four incomes. These are some of the factors that will drive the rent up with a housing shortage.

The shortage of homes is also causing the price of homes to increase as well. This makes buying a property to convert into a rental unit less attractive for those who don’t have a lot of capital. This means larger corporations can grow their businesses while smaller landlords are unable to compete in a tight market because they may have less capital.

Housing construction

Housing construction hasn’t recovered from the Great Recession and that’s not just because people got spooked by concerns of another housing bubble. The lack of construction is because of a variety of factors. For example, some regions are running out of vacant land. Because land has become more scarce, the only other option to increase the supply of housing is to increase density. Washington, like the rest of the county, has very restrictive zoning and land use policies.

Most of the zoning in the state is reserved for single-family homes making apartments or townhomes illegal almost everywhere. This puts more pressure on cities like Seattle to upzone and build more high-rises. The problem is Seattle has a number of its own hurdles that slow down the rate of construction.

While the Seattle City Council did loosen laws regarding accessory dwelling units within the city, it is riddled with lengthy permit processes that are difficult to navigate. This means if you intend to build an accessory dwelling unit on your rental property, you’ll need to plan on it taking a long time. While ADUs can be effective in creating more middle-income housing units, it isn’t enough to tackle the entire housing crisis.

Because the housing shortage is a regional issue, even when Seattle creates a path for more housing, it still isn’t enough. The problem needs to be resolved with the state legislature. In 2022, there were some attempts to pass legislation allowing small 6-unit apartment complexes near transit stops, but those bills died in committee. There’s another bill that would make allow for ADUs on single-family lots that have potential, but that won’t be enough to impact the shortage.

Because of the restrictive zoning, land shortages, lengthy permitting process, and municipal building codes, the potential for a housing construction boom is very low. This means that unless the state of Washington takes drastic measures to allow for more housing to be built, Seattle will continue to deal with a housing shortage.

Since any real estate investment needs to consider both short and long-term risks, the potential for housing construction is a valid concern. There are currently no signs that the state or even the city of Seattle are going to make the changes necessary to spur construction and even if they did, the impact of those changes would take time. Even with a housing shortage, rent increases can slow over time, but they should continue to increase and stay high over time.

Rent increases

Rent is rapidly rising all over the country and is one of the main drivers of inflation. According to Apartmentslist.com, the national average for a rent increase is 10% over the last 12 months. Seattle’s average rent increase over the same period is slightly lower at 5.8%. This is partial because people in high-rent areas have been relocating to the few places that did have a housing surplus but have since vanished.

Compared to similar major cities throughout the country like San Franciso and New York City, Seattle has the 5th highest median rent for a two-bedroom apartment. Cities with fewer apartments in the Seattle area have seen their median rent increase at an even faster pace than Seattle, and some of those cities have even higher rent. This is because those cities tend to have fewer one and two-bedroom apartments.

Rent can vary depending on the neighborhood in Seattle as well. When it comes to buying a new unit or renting an old one, you’ll need to research what the typical rent for that neighborhood is. For example, Pike Place Market is the most expensive for one bedroom with an average price of $3,215 a month. The next highest has a significant drop and that’s South Lake-Union with an average rent of $2,771.

The rate at which rent increases will depend on both the housing stock of the city and the neighborhood as well as how a housing unit fits into the demand of the neighborhood. If there is a huge demand for one-bedroom units for young professionals but the supply is low on one-bedroom, rent will increase even faster for one-bedroom.

When it comes to investing in a new rental unit or deciding to rent out your current home, you’ll want to research not just what the overall rent is in the area. You’ll want to research the rent trends for similar units to the one you intend to lease.

Mortgage rates

The high cost of housing can be a deterrent for those who are looking to enter into the rental market. Buying an investment property with a high mortgage payment is a risky endeavor. While the housing shortage means rent will continue to increase year over year, there’s a good chance the first few years you could break even, or take a loss.

This means large investment groups with a lot of capital have a huge advantage in growing their business, while the small business landlord will find it difficult to grow their business. On the one hand, rent will increase on your current properties, on the other, there won’t be many opportunities to grow your business without taking on substantial risks.

With interest rates increasing, there many situations where the mortgage payment will be substantially more than whatever you can collect with rent. In May of 2022, the average mortgage payment in Washington was $2,800 and the interest rates have since increased. The good news for landlords is this can keep new buyers out of the market because they would rather pay a few thousand dollars in rent than four or five thousand a month in mortgage payments.

This can keep the demand for rental units higher for the time being and while it may be difficult to grow your business, you should see a steady increase in revenue. If you do have enough capital to continue to invest with the high mortgage rates, you can always refinance once interest rates drop.

One way to slowly build your investment property portfolio is to upgrade your home every few years. This way you aren’t just buying investment properties and trying to rent them out. You’re buying a new home to live in while leaving a perfectly habitable home that is ready to rent immediately. You’ll have the added advantage of rent prices that won’t leave you taking a loss. This is a way you can slowly work your way up over the years from a studio condo all the way to a single-family home. As long as rents continue to increase, they should become even more profitable over time.

Getting help

Managing any small business can be difficult. Growing and managing a real estate business is extremely risky and difficult. You need to be knowledgeable in a wide range of fields where most large corporations will hire professionals for each area of expertise. You need to understand fair housing laws, finance, tax codes, maintenance requirements, and so on.

One way to help manage your business is using software like Ziprent. Ziprent will help you manage your properties through [tenant placement services](https://www.ziprent.com/seattle-tenant-placement) to make sure you rent your properties quickly with the ideal tenants. You’ll also have access to local data to help you make decisions about how much to charge.

Ziprent has quick and easy web portals for both landlords and tenants. This allows tenants to submit both rent payments and maintenance requests. Landlords can receive the payments and the money then gets directly deposited into your business account. The landlord web portal will also have access to in-depth reporting that used to be reserved only for the big real estate firms.

Consider getting help with legal and rental property tax deductions. The real estate industry and tax codes are complex and can take professionals years to learn how to navigate without creating unnecessary risk. Even if you can’t afford to hire anyone full-time, you can keep a lawyer and accountant on retainer to help you protect both yourself and your business from any liability.

Finding a reliable broker can be incredibly helpful as well. They can keep an eye out for any properties that might interest you and notify you as soon as they go on the market. They can also help you with any information regarding zoning and housing laws to see if a lot has the potential for more units to be built on it.

Don’t be afraid to ask for help. As a landlord, you take on a lot of work and risk. It’s a business and it’s important to treat it as such, not just some way to get passive income. The more seriously you take managing your properties, the easier it will be to grow and increase your personal wealth.